Stay buckled up friends, because the first several months of 2025 felt like driving on an unmarked road full of potholes, detours, and unexpected turns that no GPS system could have predicted. It can be a tricky business–staying ahead and informed in a market landscape as muddy as ours has been. As you’ll see in our reporting, even as objectively “hard data” occasionally signals a hopeful stability, “soft indicators” (ie: subjective influencers like builder confidence and consumer sentiment) continue to reflect a pervasive sense of hesitance. All in, collective data continues to amplify the atmosphere of uncertainty which has permeated our industry since January. However, at Belco, we’re digging into, and even embracing the contradictions, adjusting strategies, and preparing for successful travels along the bumpy road of Q2 and beyond.

Housing Activity: Mixed Signals and Regional Divergence

According to the latest U.S. Census New Residential Construction data, SF housing starts at the national level dropped 14.23% month-over-month and nearly 10% year-over-year, settling at an annualized pace of 940,000 units. Permits slipped just 2% from March and are roughly flat compared to March of 2024.

At the national level SF starts YTD are down 5.64%, while permits are off by 3.85%. Builder sentiment reflects these shifts. As NAHB Chairman Buddy Hughes explained in HBS Dealer: “The drop in March housing starts is a clear signal that the affordability pressures are intensifying.” Danushka Nanayakkara-Skillington, NAHB’s VP for Forecasting and Analysis elaborated, saying the “decline in housing production reflects the ongoing struggle to balance construction costs with the need for affordable housing. High material prices and labor shortages continue to challenge our ability to build homes that meet budget constraints of many families.”

Regional Breakdown

- South: Despite the drop in both starts and permits from last month, permits have been trending upward overall since November. If that trend continues to hold, it could point to a surge in momentum later this year, though turbulence remains high.

- West: The SAAR pace of starts plunged 15% month-over-month, yet are up 3.5% over last year. However, permits are trending down in both comparisons. Interestingly, actual YTD starts are up 11% compared to early 2024, reflecting some front-loaded activity for the year in this region.

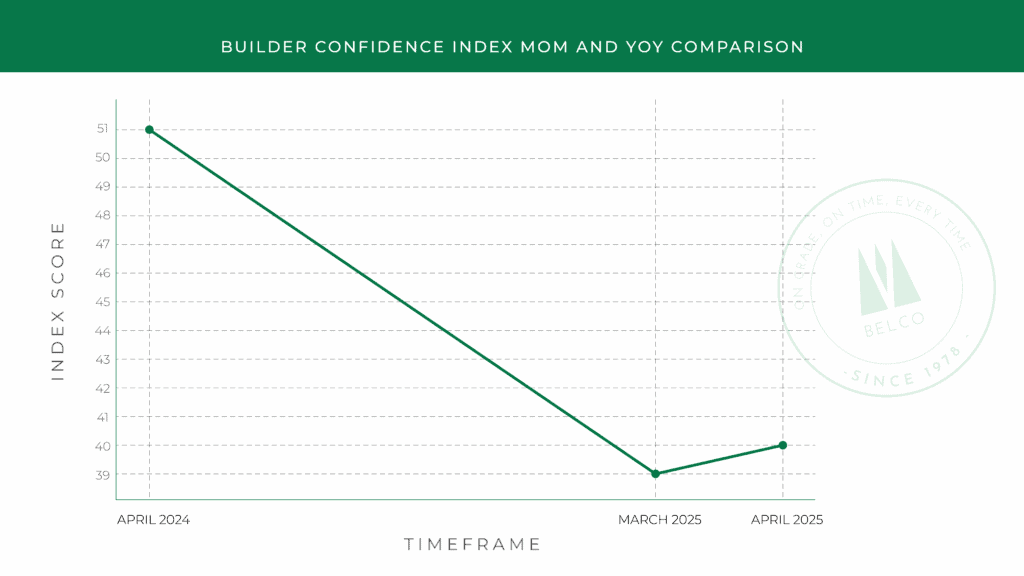

Builder Confidence and Buyer Behavior: A Standoff

National builder confidence inched up only very slightly to 40, according to the NAHB/Wells Fargo Housing Market Index. Here is a visual understanding of how this slight Month over Month confidence increase sits in the context of a Year over Year comparison:

Additionally, a closer look at the forecasting reveals a market that is still struggling to find its footing:

- Current sales conditions rose to 45

- Future expectations fell to 43

- Buyer traffic nudged up to 25

Price cuts and sales incentives remain the strategy of the hour. In the latest HMI survey, 29% of builders report offering discounts (unchanged from March), while incentives climbed to 61% in April, up several percentage points from the previous month.

According to the LBM Journal, “Growing economic uncertainty stemming from tariff concerns and elevated building material costs kept builder sentiment in negative territory in April, despite a modest bump in confidence, likely due to a slight retreat in mortgage interest rates in recent weeks.”

Affordability, Tariffs, and the Cost Squeeze

Some stability is returning to both home prices and mortgage rates, even if only slightly. The Case-Shiller Home Price Index rose to 324.92, while mortgage rates have settled in the mid-6% range (most recently 6.76%). This recent sense of steadiness could potentially coax some buyers back into the market, but from a macro viewpoint, affordability challenges remain a considerable hurdle.

Of continual and growing concern are new tariffs looming over the industry. Belco’s Sr Business Analyst, Julie Bradley-Rowan points out, “Though no formal tariff has been levied on Canadian softwood lumber yet, countervailing and anti-dumping duties are scheduled for Q3.” Moreover, Zonda reports that:

- 60% of builders say suppliers have already raised or announced price hikes

- The average cost increase is 6.3%

Builders estimate $10,900 in additional costs per home due to recent tariff actions

Forecasts: Short-Term Friction, Long-Term Opportunity

The NAHB’s April forecast has inched slightly upward, projecting 1,031,000 SF housing starts for 2025, a modest 1.68% increase over 2024. But the outlook for Q2–Q4 is far less bullish, with activity expected to decelerate after a relatively strong Q1.

Meanwhile, Zonda’s forecast is more cautious, anticipating a 5% drop in starts for 2025, bringing volume closer to 2023 levels. Chief Economist Ali Wolf observed: “The market is slogging along.” While new home sales are outperforming 2019 in some areas, any sense of true urgency remains elusive, keeping the usual market players posted up on the sidelines.

Final Thoughts: Stay Nimble, Stay Ready

While the housing market in 2025 is not stalling, it is stuttering. Builders, suppliers, and stakeholders should be prepared for continued inconsistency. As mentioned before, objective data may look steady, but soft indicators, like sentiment and buyer urgency, are flashing yellow. And when soft data turns, hard data can tend to turn with it.

At Belco, our strategy remains the same: lead with resilience, stay alert to opportunity, and adjust quickly when conditions change. As we enter the bumpy middle of the year, it’s worth remembering the words of Charles Darwin:

“It’s not the strongest of the species that survive, nor the most intelligent, but the one most responsive to change.”

Let’s continue to adapt—and lead—with that in mind.