“The pessimist complains about the wind; the optimist expects it to change; the realist adjusts the sails.” — William Arthur Ward

2025 has thrown its fair share of curveballs, and May was no exception. As interest rates hold stubbornly above 6%, permits decline, and builder confidence dips, the housing market can feel like trudging uphill. However, at Belco we believe resilience isn’t passive, it’s informed, strategic, and intentional. This month’s insights highlight what’s changing, what isn’t, and how to adjust our footing for the long hike ahead.

Market at a Glance

The latest U.S. Census data shows single-family starts down 2.11% month-over-month, and 11.8% below last year, now pacing at 927,000 units nationally. Permits followed suit, falling to 922,000 (down 5% MoM and 6% YoY).

Year-to-date (YTD) comparisons echo the slowdown:

- 313,400 units started Jan–April 2025 (vs. 337,400 in 2024)

- 320,500 permits issued YTD (down from 335,600)

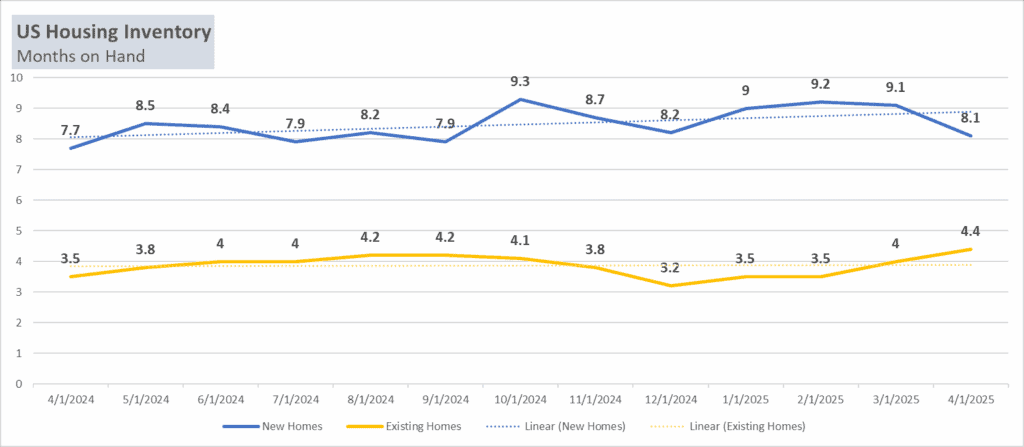

New home prices are beginning to stabilize. While median prices dropped 2%, average prices nudged upward by 1%. Mortgage rates ticked up slightly to 6.89% by May 29, still below last year’s 7.22%. As for inventory:

April unsold inventory sits at 4.4 months’ supply, still below the balanced range of 4.5–6 months. This points to a continued competitive atmosphere for new home builders.

Regional Check -In: South & West

Regional trends remain uneven, and watching them closely may offer clues as to where opportunities could open up next.

South

In the South, there’s a slight uptick in activity, with starts rising just under 2% from March. While this is a modest gain, it is notable against a backdrop of year-over-year decline nearing 15%. Builders in the region remain understandably cautious, but there is a glimmer of hope and reason for longer-term optimism; permit activity has been on a steady incline since late 2024. If this trend of consistency holds, we could see stronger market performance heading into fall.

West

Meanwhile, the West is still in the process of resetting. Starts took a steeper drop, down 18.67% month-over-month, and about 15% below last year. However, the year-to-date numbers paint a more nuanced picture for us. Starts in the region are actually up just over 2% compared to the same timeframe in 2024. While current permit activity is sluggish, the early-year strength offers a little encouragement that this is more of a leveling-off than a full retreat.

The Builder Experience: Strategies for Staying Competitive

Builder sentiment took a hit in May, falling to a national reading of 34 on the NAHB/Wells Fargo Housing Market Index:

- Current sales conditions: 37 (–8 points)

- Future expectations: 42 (–1)

- Buyer traffic: 25 (–2)

According to NAHB Chairman Buddy Hughes, the dip reflects continued hesitance on several fronts: tariff uncertainty, interest rates, and ongoing construction costs. However, motivated builders have been continuing in the strategies that keep things moving. Notably, 34% of builders dropped prices to boost sales – the highest rate since December 2023 – and 61% are using buyer incentives to stay competitive.

Despite the consistent uphill grind, optimism isn’t completely lost. As Hughes pointed out in LBM Journal, most of their survey responses came before the May 12 U.S./China tariff pause. If trade talks progress, builder confidence could rebound heading into late summer.

Looking Ahead: Stay Diligent - Stay Strategic

Heading into June, the NAHB’s updated forecast now calls for 1,014,000 starts in 2025, revising earlier expectations slightly downward. That figure now aligns almost exactly with 2024 totals, suggesting that 2025 is likely to be another year of treading water more than slingshotting forward as previously hoped.

Quarters two and three are expected to remain soft, with more meaningful gains likely holding off until Q4 or early 2026. Still, economist Ali Wolf notes that new home sales remain above 2019 levels largely due to builders staying aggressive with pricing and incentives. That willingness to adapt is what’s keeping momentum alive, and is a testament to builder-resilience in a market atmosphere with relatively “low visibility” from so many unknowns.

Final Word

For Belco, data-informed agility is intrinsic to our operating model, and a cornerstone of how we serve our partners dependably. Staying nimble with supply, keeping trim quality consistently premium, and aligning closely with real-time demand are how we’ve helped customers weather rough market cycles before. We’ll continue to do this, shoulder to shoulder with the builders and dealers who rely on us. 2025 may not be the bounce-back year many hoped for, but it’s not a total bust either. It’s a year of recalibration. As buyers wait and builders adjust, those who strategize instead of stall will come out ahead.