Beneath the surface of cautious forecasts, the construction industry is proving its steadfast resilience despite ongoing challenges. While the overall economic data doesn’t indicate rapid growth, opportunities remain for those prepared to navigate market fluctuations. The market may not offer easy wins, but it does reward those willing to innovate, adapt, and create their own momentum.

Housing Starts and Permits: National and Regional Trends

National Trends

The outlook for single-family homes remains stable, albeit with persistent affordability concerns and regulatory challenges. Single-family home construction increased by 6.5% in 2024, per the Lumber Commentary from RISI. The NAHB also anticipates modest growth in 2025, driven by continued housing shortage and steady economic conditions. However, builders continue to face higher construction costs and elevated mortgage rates.

Southern Region

The South’s housing start pace remained flat compared to both the previous month and last year. Permit activity rose 3% month over month but remains 3% lower than a year ago. Since June 2024, permits have trended upward, signaling potential growth in early 2025.

Western Region

Housing starts in the West rose 7% from last month but are still 15% lower than a year ago. Permit activity remained relatively flat month over month and down 7% year over year. However, permits have held steady since June 2024, indicating a stabilizing market.

Builder Confidence Holds Steady

According to LBM Journal, “Builder sentiment edged higher to begin the year on hopes for an improved economic growth and regulatory environment.” However, builders are wary of material costs, tariffs, and inflation’s impact on mortgage rates. In January, 30% of builders reduced prices to stimulate sales, while 61% used sales incentives, marking a slight increase from December.

The NAHB Builder Confidence Index edged slightly higher to 47 in January.

- The South saw a 2-point drop, bringing it to 47.

- The West gained 3 points, reaching 42.

- Current sales conditions and buyer traffic improved, though sales expectations for the next six months dipped due to interest rate concerns.

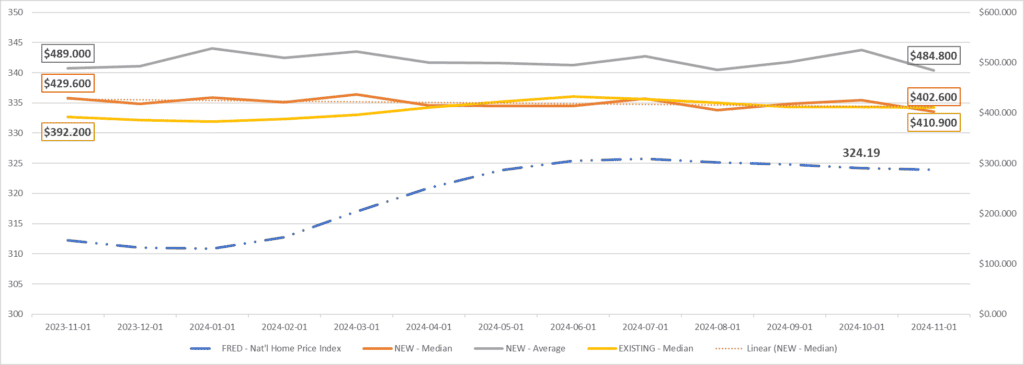

Home Prices & Affordability Pressures

Affordability remains a critical challenge. The 30-year mortgage rate hovers around 7%, with the January 23 reading at 6.96%, slightly above last year’s level. This continues to pressure affordability and buyer demand. However, new home prices did continue to soften slightly, while existing home prices held steady:

- New home prices dropped 5-8% month over month as buyers rushed to close deals before year-end.

- Existing home median prices held steady from October but remain 4% higher than a year ago.

- The Case-Shiller US National Home Price Index dropped slightly for the fourth consecutive month, reflecting ongoing softening in existing home prices.

The 2025 Forecast: Slow but Stable Growth

The NAHB Executive-Level Forecast projects 1,007,000 annualized single-family housing starts, representing only 0.52% growth over 2024. Single-family homes will account for 74.63% of total housing starts.

According to LBM Journal, “NAHB is forecasting a slight gain for single-family housing starts in 2025, as the market faces offsetting upside and downside risks from an improving regulatory outlook and ongoing elevated interest rates.” While easing Federal Reserve policies may help some private builders, mortgage rates nearing 7% continue to cause buyer cancellations.

Key Market Challenges & Opportunities

Challenges:

- Inflation: The shelter component remains 4.6% year over year.

- Labor Shortages: The construction industry needs 439,000 additional workers to meet 2025 demand (LBM Journal).

- Inventory & Incentives: New home supply sits at 9 months, up from 7-8 months in 2024. (Builder and Developer Magazine)

- Tariffs & Material Costs: Trade restrictions could push up the cost of lumber and other essential materials, further straining affordability.

- Market Uncertainty: Some industry players may feel stuck in a waiting game, as numerous potential changes remain uncertain or unpredictable. This hesitation, especially if widespread, could lead to delayed investments, slower project starts, and a cautious hiring approach, ultimately impacting industry momentum.

Winning Moves:

- Target regions showing strong permit activity momentum.

- Craft attractive pricing and incentive packages that move inventory.

- Stay ahead and align strategy with Federal Reserve policy shifts affecting mortgage rates.

Blueprint for Success

The blueprint for success in 2025’s market landscape won’t likely be found in waiting for perfect conditions; rather, it will be drawn by those who architect their own opportunities. While difficulties remain, companies that combine strategic vision with tactical agility will find ways to build value even in challenging times.