In this month’s residential construction industry market report, we evaluate national and regional data, specifically focusing on “under construction” metrics, mortgage interest rates, and forecasted builder sentiment in 2024. Our analysis aims to provide understanding of the current trends and future prospects in the real estate market and construction industry. At Belco, we know that paying attention to market indicators sets us and our valuable trade partners up for success. Even when market signals aren’t optimally trending, savvy industry pros are optimally planning.

Residential Construction Industry: Under Construction Data

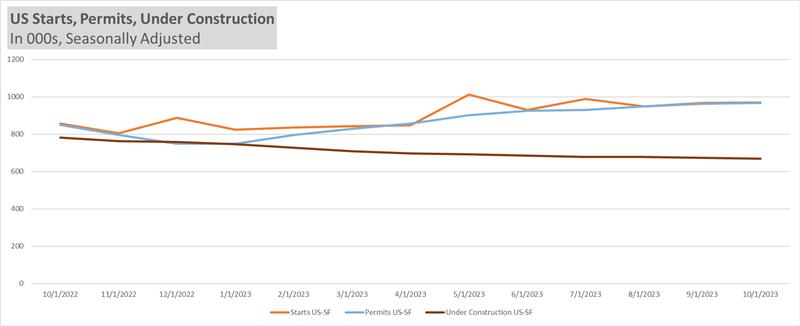

Unlike starts and permits, under construction data has taken a distinctive path over the past year. While single-family (SF) starts and permits have steadily risen in the last 12 months, under construction numbers have shown a downward trend. This national-level phenomenon is consistent across all regions, though the severity of the gap varies.

Builders are currently grappling with various challenges, contributing to the continuation of this trend. It is anticipated that the pattern will persist into the first quarter of 2024. A boost in activity is expected once starts and permits materialize, particularly as builders continue to expedite permits to beat code requirements.

Builder Confidence and Market Conditions

Builder confidence, as measured by the HMI index, has taken a hit, plummeting by 6 points to 34, the lowest reading since December 2022. This decline is partly attributed to rising mortgage rates, which reached 7.76% on November 2. Additionally, home prices have increased by 0.3% from the previous month, 3.93% from the same period last year, and a substantial 15.04% from two years ago.

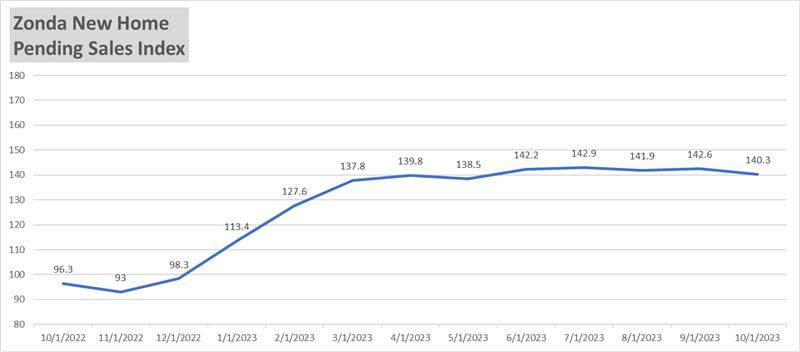

The impact of these factors on the residential construction industry is evident in the decline of the HMI reading for the index related to prospective buyers, which dropped to 21. We are witnessing a continued slowdown in home sales, with the NAR Pending Home Sales Index hitting its lowest point all year at 71.4. The Zonda New Home Sales PSI, while maintaining stability and surpassing the second half of 2022, experienced its lowest reading since May.

Forecasting Optimism

Despite significant challenges, there is optimism on the horizon. According to the LBM Journal, “While builder sentiment was down again in November, recent macroeconomic data point to improving conditions for home construction in the coming months. In particular, the 10-year Treasury rate moved back to the 4.5% range for the first time since late September, which will help bring mortgage rates close to or below 7.5%. Given the lack of existing home inventory, somewhat lower mortgage rates will price-in housing demand and likely set the stage for improved builder views of market conditions in December.”

Additionally, the National Association of Home Builders (NAHB) forecasts a 3.71% increase for single-family starts in 2024. The Executive Level Forecast positions this growth slightly above 2019 levels, marking a return to a healthy market according to industry experts. While the fruits of this positive outlook may take a few months to materialize, the signs point towards a more consistent housing construction market in 2024.