Next-Gen Wood Treatment and Forest Stewardship

Advances in wood treatment and forest management practices often begin from the efforts of stubborn optimists who refuse to accept the limitations of the status

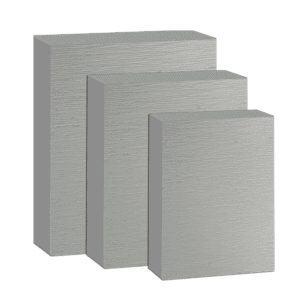

Preservative treated and primed SPF exterior trim ready for installation and top coat finishing.

Learn more

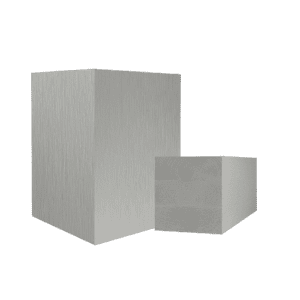

Fully laminated columns engineered with structural design values to carry heavy loads.

Learn more

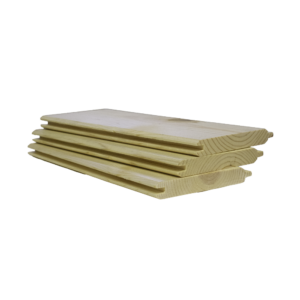

Belco T&G is graded smooth face with edge vees on all four edges and a textured ungraded back.

Learn more

Preservative treated and primed SPF exterior trim ready for installation and top coat finishing.

Learn more

Fully laminated columns engineered with structural design values to carry heavy loads.

Learn more

Belco T&G is graded smooth face with edge vees on all four edges and a textured ungraded back.

Learn more

Advances in wood treatment and forest management practices often begin from the efforts of stubborn optimists who refuse to accept the limitations

Download our product one-pager to learn more about Belco XT Products

Advances in wood treatment and forest management practices often begin from the efforts of stubborn optimists who refuse to accept the limitations of the status

Seasoned builders and contractors know that sometimes the most overlooked renovation details, like fascia board replacement, are the structurally essential and visually appealing updates homeowners

Understanding the difference between flashing vs fascia is basically “Roofing 101” with a few simple, yet important distinctions. Both are essential components but serve different

How About the Bottom Line First Navigating the lumber industry’s current landscape isn’t straightforward. Uncertainty over tariffs—whether they will remain, be adjusted, or removed—has left

Fascia boards are an essential component of any roofing system. They are mounted at the point where the roof meets the outer walls of the

Garage doors are an important part of many properties. They offer security for the home, and they also help create the final curb appeal or

Which Porch Post Material Is Right For You? Porch posts (also called “pillars” or “columns”) serve as necessary structural support for the porch roof, and

2025 is shaping up to be another nuanced year for builders, demanding an ongoing commitment to resilience, efficiency, and regionally informed agility. While some reporting

Southern California’s visually rich architectural landscape is as diverse as its coastline. The region offers a rich mix of design influences from modern beach homes

Reduce trim waste with this guide to the optimal window trim cutlist. Download the Guide

Our Happy Customers

Preservative treated, primed, and available with a combed, brushed, resawn, or smooth face. The real beauty of your home comes to life through a well made trim package.

Preservative treated, primed, and available with a combed or smooth face. These glulam columns are strong, beautiful, and enhance any exterior design.

Belco XT®-T&G is graded smooth face with edge vees on all four edges and a textured ungraded back.