After a turbulent start to the year, the construction market forecast is defying expectations with a surprising autumn upswing, signaling momentum as we finish up the final quarter of 2024. Despite fluctuations in building permits and affordability concerns, steady growth in housing starts and rising builder confidence hint at a more resilient market than previously anticipated.

Regional Construction Market Forecast Variations

With the South and West showing signs of renewed strength, there’s hope that the remainder of Q4 will bring steadier ground and fresh opportunities. The following insights, drawn from the U.S. Census New Residential Construction report, highlight where these promising trends are emerging. In both areas, shifting permit and start rates hint at where builders may face headwinds or find momentum.

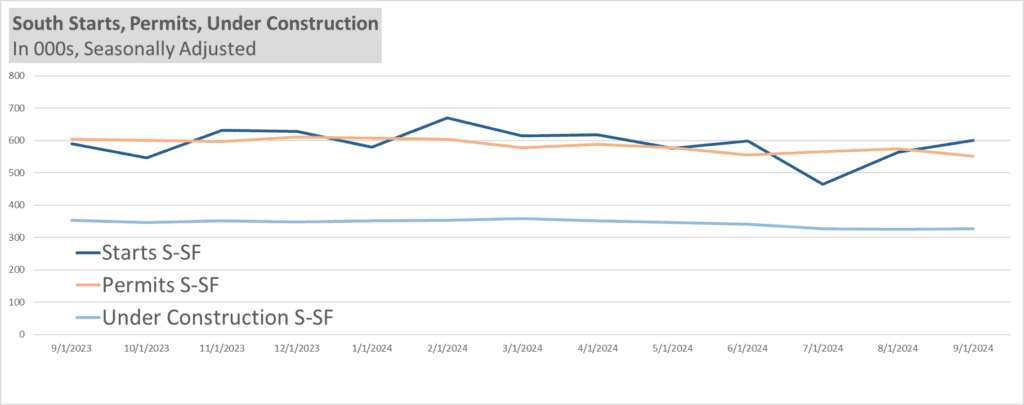

The South Sustains

In the South, housing starts have shown a steady upward trend, with September marking a 6.56% month-over-month increase. This growth brings year-over-year gains to 1.86%, evidencing resilience in the market. However, with building permits dropping by 4% month-over-month and 8.46% year-over-year, the future may hold challenges as this demand catches up to permitted projects. For now, the outlook is positive, especially in the short term as builders push forward during the cooler months before activity likely levels off.

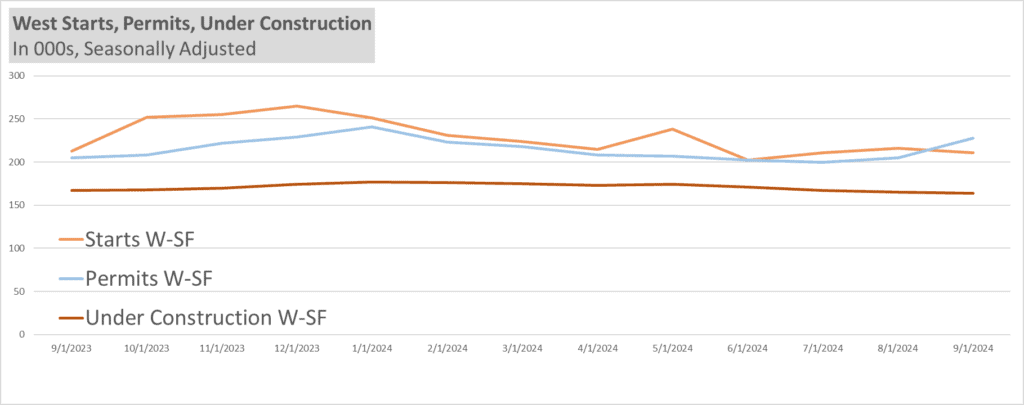

Western Regional Rebound

In the Western U.S., both housing starts and permits faced a prolonged dip earlier in the year. However, recent data suggests a comeback, with permits jumping 11.22% month-over-month and year-over-year. Starts showed a minor decline in September (-2.31% month-over-month, -0.94% year-over-year), but the overall trend is favorable. Seasonality may slow some parts of the West temporarily, but as conditions improve, the region is well-positioned to ramp up in early 2024. The trajectory of the South is somewhat responsive as well, but the Western bounce back is cause for optimism.

Builder Confidence on the Rise

Builder confidence nationwide is strengthening, with the national confidence index up two points to 43. The South and West regions each rose three points, reaching 43 and 44, respectively. According to LBM Journal, this improvement is partly driven by easing inflation and moderating mortgage rates, although affordability remains a challenge. The LBM Journal cautions, “…while housing affordability remains low, builders are feeling more optimistic about 2025 market conditions. A wildcard for the outlook remains the election.”

Notably, the October Housing Market Index (HMI) survey revealed that 32% of builders maintained price reductions to boost sales, while the use of sales incentives climbed slightly to 62%, up from 61% in September. This cautious optimism indicates builders’ confidence in the market’s ability to support gradual growth.

Affordability Challenges Persist

New home prices continue to trend downward. Both the New Home Median Price and New Home Average Price declined month-over-month and year-over-year for August. While the existing home median price also dropped by about 2% month-over-month, it remains 5.34% higher than last year. This continues to give new construction a slight price advantage, but that gap is closing.

While some base price pressures may be easing, mortgage rates continue to meander through fluctuations. As of October 24, rates stood at 6.54%—down nearly a full point year-over-year but up 0.40 points since the beginning of October. LBM Journal notes, “Despite the beginning of the Fed’s easing cycle, many prospective home buyers remain on the sideline waiting for lower interest rates. NAHB is forecasting uneven declines for mortgage interest rates in the coming quarters, which will improve housing demand but place stress on building lot supplies due to tight lending conditions for development and construction loans.” Consequently, as we head into the final stretch of 2024, affordability will remain a key hurdle for many homebuyers.

Market Outlook for 2024 and 2025

According to the latest NAHB Executive Level Forecast, single-family starts for 2024 have been revised upward by 0.48%, bringing the total forecast to 1,003,000 units and representing 5.77% growth over 2023. For Q4 2024, starts are expected to maintain an annualized pace of 991,000 units, a 3.6% improvement over Q3. This projection remains regionally dependent, particularly as winter weather may slow some areas.

Looking even further ahead, the 2025 forecast has been revised up by 0.50 percentage points to 1,024,000 units, reflecting a projected 2.09% growth over 2024. This gradual, steady market growth underscores the importance of strategic planning and adapting to market conditions to keep pace with the industry’s growth goals.

Final Thoughts

Despite a challenging economic landscape, the residential construction market forecast shows promising signs of stability. Belco’s Sr. Business Analyst, Julie Bradley-Rowan encourages, “There will of course be challenges along the way but if we stick to our plans, strategies, and make pivots when necessary, we can continue to come out on top.” Builder optimism, easing inflation, and mortgage trends all signal potential for growth, even amid uncertainties. While obstacles remain around affordability and borrowing conditions for land development, staying agile and informed will buttress wins.