Every new year brings fresh optimism, and for the construction and lumber industries, 2025 appears poised to present professionals the chance to alchemize challenges into success. Belco wrapped up December ahead of forecast and finished 2024 having surpassed its plan. With a resilient foundation and a clear-eyed view of the market, Belco leaders are ready to build on this momentum.

Start & Permit Data: Mixed but Up-trending Signals

The U.S. Census Bureau’s latest New Residential Construction Data reveals plenty of complex interplay at work. According to Carl Harris, chairman of the National Association of Homebuilders (NAHB), “While single-family starts were up in November, single-family permits were flat as builders face mixed market conditions that include an election result that promises a focus on regulatory relief, but ongoing elevated mortgage rates” (HBS Dealer). Additionally, despite year-long fluctuations, single-family starts settled at a 7.4% average increase over 2023, according to RISI’s Lumber Commentary.

Regional Breakdown

South: Starts surged 18.29% month-over-month but remain down 1.58% year-over-year. Permits improved 1.78% monthly but are still 4% lower annually. Encouragingly, permit activity has trended flat-to-up since mid-2024, indicating consistently positive momentum.

West: Starts dipped over 7% month-over-month and are down 16.86% year-over-year. Permits declined slightly (under 1%) month-over-month and are 4% lower than last year. However, the flat-to-up trend in permit activity since June 2024 hints at a more stabilized 2025.

Builder Confidence: A Patchwork of Cautious Optimism

Builder confidence held steady in December, with the national index reading at 46. This stability reflects the ongoing themes of optimism and caution, driven largely by the “sales expectations in the next six months” indicator, which rose three points to 66; the highest level since April 2022. Regionally, however, confidence levels varied. The South saw a notable six-point increase, reaching a reading of 48, signaling stronger expectancy. In contrast, the West experienced a one-point dip, settling at 38, reflecting the region’s ongoing challenges but also aligning with the improving trends in permit activity.

Builders remain cautiously hopeful despite elevated construction costs, high interest rates, and limited lot availability. As LBM Journal notes, “Builders are anticipating future regulatory relief in the aftermath of the election.” Meanwhile, December survey data revealed that 31% of builders continued to drop prices to boost sales, and 60% used sales incentives.

Affordability: Persistent Pressures

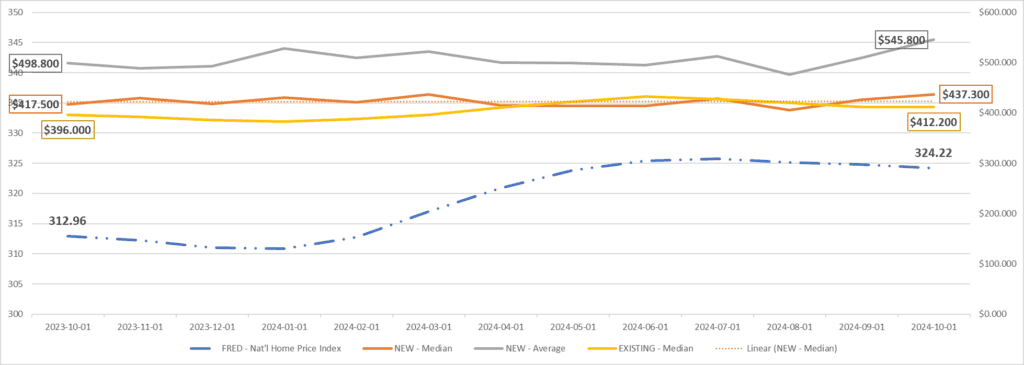

Affordability remains a concern as pricing trends upward, with a steeper year over year increase in new home construction:

- New Homes: Median and average prices increased 2–7% month-over-month and are higher than a year ago.

- Existing Homes: Median prices stayed flat in October but remain 4% higher year-over-year.

The Case-Shiller U.S. National Home Price Index dropped 0.17%, marking a third consecutive monthly decline, yet the index remains 3.5% higher than a year ago.

Mortgage rates remain a frustrating barrier heading into the new year. The rate reached 6.85% in late December, narrowing the gap from last year to just 0.18 percentage points. As RISI’s Lumber Commentary predicts, “Mortgage rates hovering above 6% will stifle affordability and demand, but home prices will remain high. Rate relief will again come from the new side of the market where builders can continue to offer rate buydowns.”

Looking Ahead: Modest Growth on the Horizon

The NAHB Executive Level Forecast reflects that total single-family starts were revised up by 0.0.42% to 1,005,000 units, for 5.93% growth in 2024 over 2023. Additionally, Q4 2024 is forecasted to come in at an annualized pace of 983,000 units, 1.39% better than Q3. For 2025, projections show a slight downward revision to 1,011,000 annualized starts, still reflecting 0.64% growth over 2024. As NAHB Chief Economist Robert Dietz states, “The NAHB is forecasting a slight increase for single-family starts in 2025, ‘as the financing conditions for builders improve modestly’…‘The significant decline for apartment construction is forecasted to end, with that market stabilizing during the second half of next year’” (HBS Dealer).

Final Thoughts: Staying Ahead in a Shifting Market

As we step into 2025, the market landscape remains notably similar to last year. This moment presents an ideal opportunity to align strategic plans with current industry data to ensure growth trajectories are well-calibrated. Realtor.com’s newly released Top Housing Markets for 2025 highlights the continued dominance of the South and West regions. Whether targeting these growth markets or exploring more volatile territories, thorough analysis and risk assessment are requisite components for success.

Belco’s Sr. Business Analyst, Julie Bradley-Rowan reminds us, “Keep calm and build on!” – a sentiment that perfectly captures the measured approach needed in today’s market.