“Success is not built on certainty but on adapting to uncertainty” – Anonymous

If the housing market could talk, this might have been its motto in 2024. Many feel that the only consistency in the construction industry this year was its inconsistency. Fluctuating hurdles across many key areas tested even the most analytically guided professionals. However, Belco’s data driven approach to problem solving and efficient forecasting fuels resilience and creates opportunity for savvy market players. Keep reading for a breakdown of key trends, data, and forecasts shaping the industry as we prepare for a strong finish to the year and set goals for 2025.

Start & Permit Data: Regional Highlights

As we are now 2/3 of the way through Q4, we are setting our sights on a strong finish to 2024 and looking ahead to a successful 2025. “Geography and weather played a heavy role in October’s numbers,” according to HBS Dealer. Despite these fluctuations, there may be reasons for optimism moving forward. Staying aware of regional market variations has been an ongoing theme throughout the year, and remains imperative. Starts and permit data from US Census New Residential Construction Data are helpful in getting the lay of the land in the South and West:

South

Hurricanes Milton and Helene significantly impacted October’s numbers in the South. Housing starts fell 10% from September and nearly 2% year-over-year (YoY). Permits, which have been stagnant since June, rose slightly by under 1% compared to September but remain 7% lower YoY.

West

In contrast, the West experienced a 5% month-over-month (MoM) increase in starts, though they are still down almost 10% YoY. Permits declined by nearly 3% from September but are 2.4% higher than the same period last year.

Builder Confidence: Signs of Stabilization Amid Challenges

The builder confidence index ticked up three points nationally to 46 in October. However, regional disparities remain evident:

- South: Down one point to 42.

- West: Dropped five points to 39.

According to LBM Journal, “While builder confidence is improving, the industry still faces many headwinds such as an ongoing shortage of labor and buildable lots along with elevated building material prices.”

Builder sales strategies are also evolving, with 31% of builders reducing prices to stimulate sales (a 1% decline from October) while sales incentives are being utilized by 60% of builders (down from 62%).

Affordability: A Mixed Bag

Recent pricing trends for both new and existing homes, coupled with shifts in mortgage rates, reveal a complex landscape. With home prices and interest rates remaining high, understanding the current state of the market is essential. Dr. Robert Dietz, Chief Economist of the National Home Builders Association, shares sobering commentary stating, “Ongoing elevated mortgage rates, combined with higher home prices, leave housing affordability in crisis-level conditions.” While rates are expected to decline over the next two years, sales activity will likely remain sluggish.

Pricing Trends

New Homes: Both the median and average prices for new home construction increased by 4-6% MoM in September but remained flat or slightly down YoY.

Existing Homes: Median prices dropped 2% from August but are 3% higher YoY.

Mortgage Rates

After hovering near 7% throughout November, mortgage rates dropped to 6.81% by November 27. This represents a nearly full-point decrease YoY but a 0.70-point increase since early October. Elevated rates and home prices continue to strain affordability.

Looking Ahead: 2024-2025 Forecasts

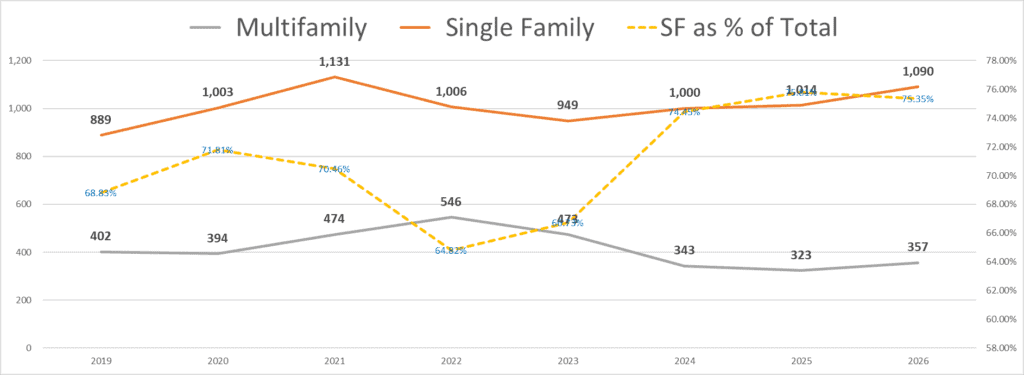

2024 EOY Outlook

The NAHB’s Executive Level Forecast revised total single-family starts slightly downward by 0.27%, now projected at 1,000,000 units—a 5.48% growth over 2023. Q4 2024 is expected to close at an annualized pace of 973,000 units, a 1.10% improvement from Q3.

2025 Projections

The 2025 forecast was revised down by 1% to an annualized pace of 1,014,000 starts. However, this still represents a 1.30% increase over 2024, signaling gradual improvement.

Final Thoughts: Overcoming Headwinds

The construction sector continues to face more headwinds than tailwinds, including labor shortages, elevated material costs, and restrictive zoning regulations. However, the underlying demand for housing reinforces the need for adaptability and collaboration across the supply chain. Craig Webb, President of Webb Analytics offers imperatives and insights in the face of these challenges. He notes that experts suggest in order to overcome the US housing shortage, we need to build at least 1.4 million new housing units annually over the next decade. Moreover, the general sentiment economically, strategically, and in terms of policy is, “Let Builders Build!”