The new residential construction market continues to face a complex landscape with fluctuating sales volumes and evolving market dynamics. Industry partners rely on detailed analysis to inform strategies in this challenging environment. This month’s Belco Bulletin provides the latest data and insights on market trends, construction activity, builder confidence, affordability, and material costs. This monthly overview serves as a guide to bolster informed decision-making for manufacturers, dealers and builders.

New Residential Construction Data

As indicated in last month’s Belco Bulletin, regional variances are important to note. The most recent US Census New Residential Construction Data demonstrates slight variances in the Southern and Western regions:

Southern Region

In the South, the month-over-month (MoM) starts number increased slightly after a three-month decline. However, permits continued a downward trend, indicating possible slower growth in the coming months.

Western Region

In the West, both starts and permits declined, with permits showing a steady decline since January. Year-over-year, starts are up for both regions, while permits are flat to down, indicating overall activity is up from 2023 but not as strong as anticipated for 2024.

Builder Confidence Index

The NAHB builder confidence index dropped slightly for the third month in a row. Nationally, the reading dropped from 43 to 42. The South remained flat at 43, while the West dropped from 38 to 37. According to a recent LBM Journal article, “While buyers appear to be waiting for lower interest rates, the six-month sales expectation for builders moved higher, indicating that builders expect mortgage rates to edge lower later this year as inflation data are showing signs of easing.”

The June survey also revealed that 31% of builders dropped prices to boost sales, and the use of sales incentives remained unchanged at 61%.

Affordability and Home Prices

Affordability continues to impact the industry. The Case-Shiller US National Home Price Index reached 323.478 in May, marking a nearly 1% increase from April, 4.11% since the start of the year, and 5.94% up from a year ago. Mortgage rates did however steadily decline throughout July, reaching 6.78% on July 25.

From the LBM Journal: “With better inflation data, the Federal Reserve is expected to begin rate reductions later this year. An improving interest rate environment will help buyers as well as builders and developers who are contending with tight lending conditions and high interest rates. And with total (new and existing) home inventory at a relatively low 4.4 months’ supply, builders are prepared to increase production in the months ahead.” Accordingly, cautious optimism continues to be the market theme throughout 2024.

Challenges for Builders

Despite declining inflation and lower mortgage rates attracting buyers back to the market, builders still face challenges. The NAHB reported that June showed the highest increase in building material prices since February 2023. Specific increases include:

- Softwood lumber rose 3.41% in June after falling 5% in May.

- Gypsum building materials were unchanged for the second consecutive month but were up 2.32% over the year.

- Ready-mix concrete rose 0.45% in June after a revised 0.26% increase in May.

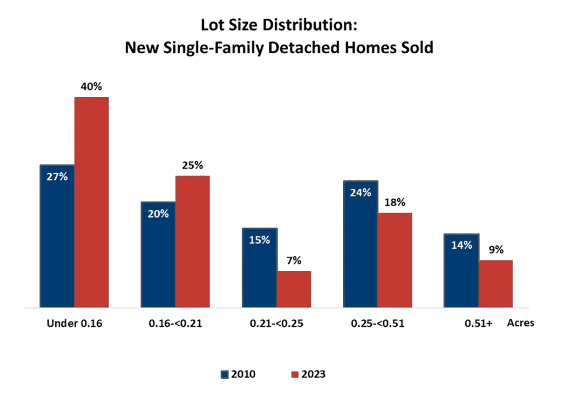

Lot Size and Availability

Lot size and availability also continue to impact the new residential construction market. According to the NAHB, “A shift in speculatively built (or spec) home building toward smaller lots continued despite the pandemic-triggered suburban flight and presumed shifts in preferences toward more spacious living. The steadily rising share of smaller lots reflects unprecedented lot shortages confronted by home builders during the pandemic housing boom, as well as their attempts to make new homes more affordable.”

While this trend towards smaller lots is recent, it demonstrates that builders are committed to bringing new homes to market at affordable prices, despite restrictions. The demand for new homes persists, requiring patience until these homes are available.

Strategic Focus: Turning Challenges Into Opportunity

Despite this nuanced landscape, the new residential construction market shows signs of resilience and potential for growth. Declining inflation and lower mortgage rates are expected to bring buyers back to the market. Builders are adapting to changing conditions with strategic adjustments in pricing and lot sizes. By staying informed and agile, savvy industry players can navigate these fluctuations and capitalize on emerging opportunities heading into the fourth quarter of 2024.