The U.S. housing market trends continue to reflect challenges and opportunities as builders and dealers navigate a fluctuating landscape. From a regional perspective, the South remains sluggish, while national factors like interest rates and affordability have continued to create mixed signals. Belco breaks down the latest market data and forecasts for home builders and dealers.

Regional Slowdowns and the Impact of Weather

Drawing from the latest US Census New Residential Construction Data, the South has experienced a steady decline in housing starts since February. July’s 22.95% month-over-month drop marks an 18.44% decline compared to the same period in 2023. This decline might seem alarming, but experts suggest it’s largely weather-related. The heavy rainfall and potential disruptions from Hurricane Beryl in Texas have contributed to that end. A rebound in single-family starts is likely as weather conditions improve and permit activity increases. Additionally, permit activity has increased, signaling that July’s numbers may have been an anomaly. As regional weather conditions stabilize, builders in the South can prepare for a potential uptick.

The Western region tells a similar story, albeit a slightly less aggressive one. Both starts and permits were down month over month as well as year over year. In contrast, the Midwest experienced a very slight decline in starts and permits, while the Northeast region stands alone, trending upward.

Builder Confidence Drops Slightly Nationwide

Predictably, builder confidence continues to edge downward, marking the fourth straight monthly decline. The national builder confidence index dipped two points, from 41 to 39. In the South, it dropped four points, while the West remained steady at 37.

Carl Harris, NAHB Chairman, notes the ongoing challenges in the current US housing market trends. He states, “Buyers remain concerned about challenging affordability conditions, and builders are grappling with elevated rates for builder loans, a shortage of workers and lots, and supply chain concerns for some building materials.”

Despite these obstacles, builders are responding to market conditions by adjusting their strategies. The August HMI survey reported that 33% of builders dropped prices to boost sales, up from 31% in July. Similarly, the use of sales incentives increased to 64%, the highest since April 2019.

Affordability: A Key Market Concern

Affordability remains a significant hurdle for potential buyers, but there are signs of improvement. Mortgage rates have steadily declined, reaching 6.35% by the end of August. This marks a 0.65-point drop from a year ago and is one of the lowest rates since May 2023. As a result, home sales have picked up. According to the NAHB, “Total existing home sales increased 1.3%…This was the first monthly gain in 4 months, although the pace of sales is still down 2.5% from a year ago.”

Despite lower rates, home prices continue to rise. The Case-Shiller U.S. National Home Price Index climbed to 325.234 in June, reflecting a 5.42% increase from last year. Builders are contending with this tension between rising prices and a more favorable interest rate environment.

New Homes More Affordable Than Existing Homes

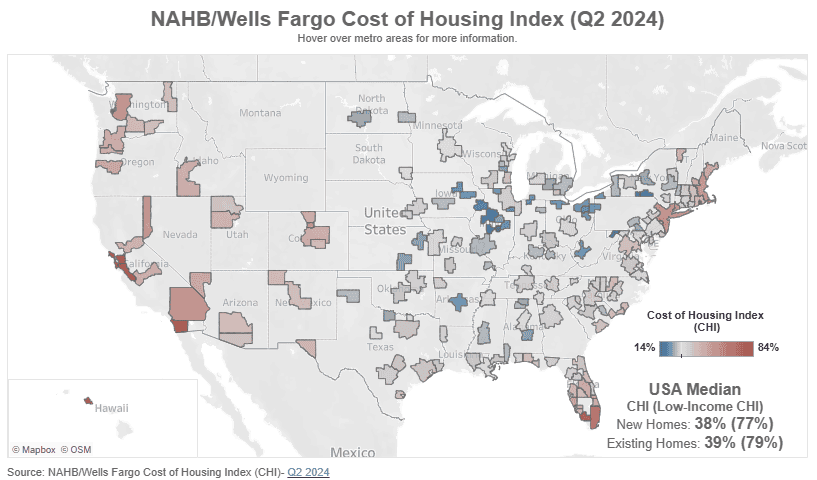

The NAHB/Wells Fargo Cost of Housing Index (CHI) helps shed light on these affordability challenges in the US housing market trends. The report highlights that new single-family homes are becoming more affordable than existing homes. On average, 38% of a typical family’s income is required to make a mortgage payment on a new home, compared to 39% for an existing home.

This gap is encouraging for builders, especially in the South and West, where the market remains cost-burdened. While it suggests potential opportunities for builders catering to new home buyers, caution is still advised due to high costs in those areas.

Revised Housing Forecast: Slow Growth Ahead

The NAHB recently released its revised Executive Level Forecast, which shows a slight drop in total single-family housing starts. The 2024 projection now sits at 1,005,000 starts, down 2.47% from previous forecasts. While this represents a lower forecast, 2024 is still expected to grow by just under 6% over 2023. However, this is a reduction from the 8.5% growth previously anticipated at the end of Q1 2024.

The forecast for 2025 has also been revised, with 1,019,000 starts projected—a minimal growth rate of 1.41%. The bottom line here is that builders should brace for a slower Q3 and Q4 in 2024 before seeing more significant activity in 2025.

Looking Ahead

The market is preparing for potential interest rate cuts by the Federal Reserve. These cuts are expected to ease some restrictions on builder loans, which may spark increased activity. With pent-up demand and ongoing affordability challenges, NAHB Chairman, Carl Harris suggests, “Additional, attainable housing supply is the only way to sustainably ease housing cost burdens for American families.”

While the US housing market trends in the near-term outlook appear uncertain, there are reasons to remain optimistic. Builders should monitor inventory levels, stay informed about regional trends, and play conservatively to weather the current market volatility. In the end, strategic moves today could lead to significant gains in the long run.

Belco Thought Leadership: Strategies to Consider

Manufacturers, builders, and dealers should consider adopting a cautious yet strategic approach for the remainder of 2024. Plan conservatively, adjust to local market conditions, and keep a close watch on economic signals like mortgage rates and potential Fed actions. Adaptability will be key to navigating the uncertainty ahead. While every company’s approach to maximizing profits during this season will be unique to them, here are some broad strokes to consider:

Manufacturers: Balance Production with Market Demand

- Monitor Regional Trends: Pay close attention to regional variations, especially in the South and West, where housing starts have slowed. However, the uptick in permits suggests potential rebounds in the South. Align production with these shifts to avoid overproduction in slower markets.

- Stay Nimble with Inventory: Given the NAHB’s forecast for reduced single-family housing starts, manufacturers might consider avoiding aggressive stockpiling. Prioritize efficiency in your supply chain, using just-in-time production methods where possible to reduce excess inventory.

- Adjust to Pricing Pressures: Builders are dropping prices and offering more incentives to attract buyers. Manufacturers can stay competitive by offering flexible pricing incentives, such as discounts on bulk orders or rebates.

Builders: Planning Cautiously Amid Mixed Signals

- Focus on Affordability: Affordability remains a top concern for buyers, even with falling mortgage rates. With the NAHB reporting that new homes are more affordable than existing homes, builders might consider adjusting product mix to cater to first-time and young family home buyers.

- Leverage Incentives: Given the recent increase in the use of sales incentives, consider offering attractive packages, such as free upgrades or lower down payments. Builders dropping prices saw sales boosts, so carefully structured promotions can drive demand in slower markets.

- Prepare for a Sluggish Market Finish: Forecasts predict that Q3 and Q4 will see reduced activity compared to the first half of 2024. Take care not to over-commit to speculative building projects, and keep lean pipelines. Finally, focus on efficiently closing out existing projects to maintain liquidity.

Dealers: Optimize Inventory and Build Supplier Relationships

- Stock Strategically: In light of the slowdown in starts, continue to stock heavy moving inventory to maintain a consistent product line meeting customer demands. However, consider avoiding overstock on products related to new construction, especially if they differ from the aforementioned “heavy movers”. Successful dealers will keep a close eye on regional variations in market conditions, and home buyer trends as we head toward year-end.

- Strengthen Supplier Ties: With supply chain concerns affecting builders, secure strong relationships with manufacturers and logistics partners. Ensuring timely deliveries of high-demand products will give dealers a competitive edge as supply chains tighten. Focus on building trade partnerships with those who demonstrate exceptional dependability and on-time deliveries. This could also be a great time to reevaluate long-standing agreements and consider courting new partnerships with like-valued manufacturers.

- Stay Flexible with Pricing: Builders are likely to pass cost savings from price cuts or incentives onto their supply chain partners. Consider adjusting margins and offer competitive pricing on materials, or bundling products to add value.

General Advice: Keep a Close Eye on the Fed

The Federal Reserve’s potential rate cuts could significantly impact the market by easing builder loan restrictions and possibly driving more activity in 2025. Keep an ear to the ground on these developments, as they could lead to a sharp turnaround in construction demand as early as Q1 2025. Prepare for this by staying informed, managing cash flow carefully, and maintaining flexibility in your operations to capitalize on any sudden market shifts.

Think Forward and Stay Strategic

In summary, the U.S. housing market trends continue to indicate affordability concerns, regional variations, and interest rates. However, there are indications for potential recovery as weather conditions stabilize and interest rates decline. To navigate the prevailing uncertainties, continuing to adopt a cautious yet adaptable approach is the name of the game.