If it feels like we’ve been reading the same housing reports over and over again all summer, you’re not wrong. Starts inch up, permits lag, builder confidence wavers, and mortgage rates won’t budge much. Repetition itself is a signal: this slowdown isn’t a passing storm cloud, it’s the very terrain we’re all trying to build on. The reality is, those who learn to work with the terrain rather than wait for it to shift are the ones who stay ahead, equipped, and relevant.

Housing Starts & Permits: The Push-Pull Continues

According to the U.S. Census, single-family starts reached a seasonally adjusted annual rate of 939,000 (up 3% from June and almost 8% higher than last year). That is hopeful data. However, builders can only build what they permit, which is why permit trends carry more weight in assessing where things really stand. Spoiler alert: permits remain weak. They’re flat compared to June and down nearly 9% year-over-year.

As NAHB Chairman Buddy Hughes told HBS Dealer, “Single-family production continues to operate at reduced levels due to ongoing housing affordability challenges, including persistently high mortgage rates, the skilled labor shortage, and excessive regulatory costs.” Chief Economist Robert Dietz added that the 621,000 homes now under construction mark the lowest level since early 2021.

Regional Realities

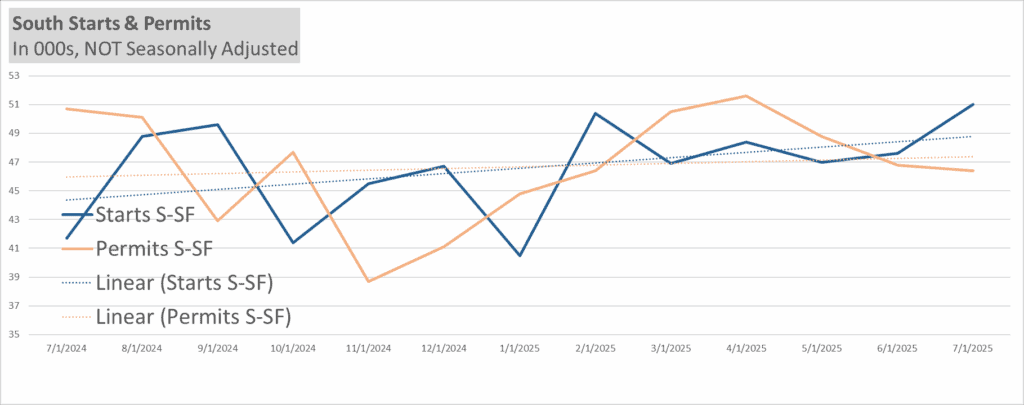

As HBS Dealer summed it up: “Overall, the US housing market is in an odd spot right now. Macro trends are tough to clearly define, making regional data all the more important to decipher.” Taken together, the South suggests meager near-term activity, while the West indicates a more significant drag on momentum. It’s a reminder that national averages can blur the real story, and regional trends are where the market truly shows its hand. This is why for builders and dealers, strategy hinges less on national headlines and more on what is happening in their own back yards.

Starts and Permits in the South:

In the South, starts surged nearly 22% year-over-year, but permits are still down 8%. The year-to-date actual data continues to show erosion, with 331,800 units started so far in 2025, a 7.14% drop compared to 357,300 at this time last year. Permits show a similar trajectory, down 6.6% year-to-date at 336,900 versus 360,700 in 2024. The takeaway? Building activity is happening now, but the slower pace of permits warns that future momentum may stumble more before it strengthens.

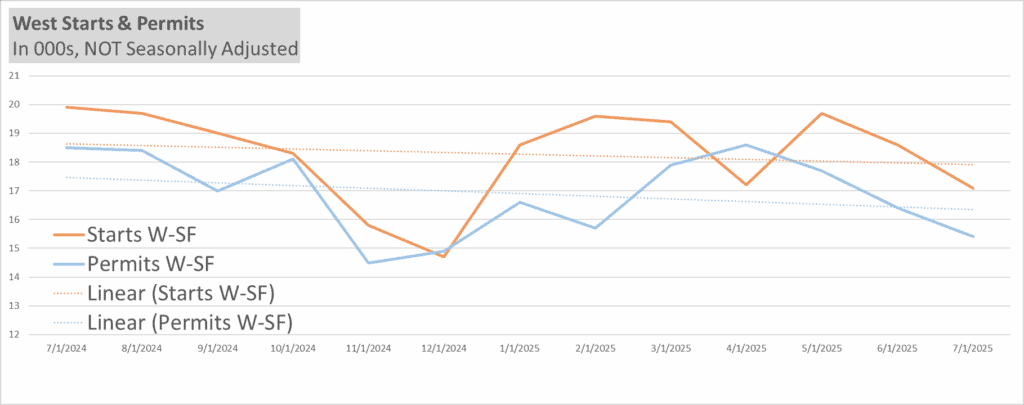

Starts and Permits in the West:

The West tells a little different story; one of persistent retreat. Starts fell nearly 14% year-over-year, while permits dropped more than 15%. Year-to-date, actual starts declined to 130,300 units, down 3% from 134,400 in 2024. Permits are off almost 10% compared to last year, with 119,000 so far versus 131,100. Frankly, this reads like the West hasn’t found its footing. Starts are slipping, permits are thinning, and the pipeline for new projects looks tighter with each passing month.

Builder Confidence & Buyer Behavior

The NAHB Housing Market Index reports that builder confidence dropped back to 32 in August. Current sales conditions slipped, future expectations held flat, and buyer traffic inched up to 22. To keep sales moving, 37% of builders cut prices, while 66% offered incentives. This is the highest level in the post-COVID era. Meanwhile, the National Association of Realtors reported a rebound in existing home sales as inventory improved slightly. Still, affordability pressures remain the roadblock keeping many buyers on the sidelines.

Pricing Dynamics: A Rare Advantage

Despite the small uptick in existing home sales, a noteworthy advantage for new home construction has emerged. For the first time in decades, newly built homes can cost less than existing ones. Realtor.com notes that new-home prices have been trending downward since late 2022, while existing home prices continue to climb. For builders, this unusual pricing inversion could provide an edge in winning cautious buyers. This lands as something more meaningful than an anomaly. In fact, it is a statistical blip that is so rare it registers on a bit of historical radar. It reflects two powerful forces at work: resale pressure from scarce listings, and builders unloading surplus inventory (often strategically at a discount) to stay liquid. While builders are taking strategic hits and choosing their battles, it’s notable that this may create an opportunity for some momentum. After all, it’s not often that new construction can compete not just on modern appeal, but also on price point.

Forecasts Revised Down

The NAHB cut its projections. Yes, again. Single-family starts are now expected to fall 8% in 2025 compared to 2024. Meanwhile, in the latest Home Building Market Intelligence webinar in partnership with Builders FirstSource, Zonda’s Ali Wolf forecasts an even steeper 12% tumble. These layered revisions indicate a deep structural realignment. Builders are dealing with fewer permitted projects, tighter financing, elevated risk, and compressed margins. Forecasts are no longer about predicting cyclical dips, but more so about strategic positioning for the next play-making moment. The rate cuts will come when they come. Now is the hour for strategic endurance over short-term sprints.

Final Thoughts: Grinding It Out

The market is telling us that caution flows downhill. Fewer sales today mean fewer starts tomorrow. Still, some measure of relief is on the horizon. NAHB Chief Economist Robert Dietz says, “NAHB is forecasting two rate cuts before the end of 2025. Doing so will provide support for those parts of the economy, particularly housing, that have been dealing with persistently elevated interest rates.” At Belco, we’ve weathered these cycles by staying nimble, maintaining an industry-leading on-time delivery rate, and offering dependable products that reduce dealer risk and increase builder margin. Waiting for rate cuts won’t win the game. What matters now is maximizing execution of what we CAN control, and managing risk to keep moving forward.

September marks the beginning of football season. A game sometimes dependent on mere inches, and grinding downfield one tackle at a time. Housing feels much the same right now. The big plays are scarce, and every scrap of yardage is hard-won. Even in markets where builders have rolled out the “red carpet” of incentives, buyers are cautious. Still, this is the season for strategy, not stalling. This may not be “the year” for housing, but it is the year to keep grinding, preparing, and advancing the ball where we can.

Practical Tips for Builders and Dealers in Today’s Market

- Lean into efficiency: Reduce callbacks and cull rates by choosing products and partners that keep projects moving without hidden costs.

- Sharpen your local lens: National averages blur the real story; track your own region closely and align inventory incentives accordingly. Don’t be afraid to think out of the box. What can you do that your competitors haven’t dared?

- Play the long game: In a slow season, reliability and trust matter more than speed. Cultivate vendor and customer relationships that will be strong when the market rebounds.

- Highlight value over volume: Position new homes not only on their design features, but also on total “cost of ownership” advantages like energy efficiency, warranties, and lower maintenance.