The US construction market trends are stirring back to life, signaling both opportunities and challenges for the housing and lumber sectors. The latest U.S. Census New Residential Construction Data shows a mixed, but improving, outlook. Fortunately, the newest data indicates a recovery in certain regions, finally offering some cautious optimism heading into Q4. So far in 2024, the name of the game has been informed forecasting, structured preparation, and efficient pivots. Belco thought leaders continue to offer insight on how to navigate challenges at every opportunity.

Regional Analysis: Mixed Signals in the South and West

When examining regional trends, it’s clear that the recovery is uneven, with the South and West showing different trajectories. The South’s slower rebound contrasts with the West’s steadier progress, highlighting significant variations in housing activity across the country.

The South: Slow Rebound

The South showed positive month-over-month growth in single-family starts and permits. However, the year-over-year data paints a contrasting picture, with both categories and units under construction still down compared to 2023. This signals that Q4 may continue to be a challenge as builders face tighter demand.

The West: Steady Progress

The West indicates a more favorable outlook. Single-family starts increased both month-over-month and year-over-year, while permits and units under construction remained relatively stable. This suggests that the West may provide steadier demand in Q4, compared to the South, where recovery will take more time.

Builder Confidence Rises on Lower Interest Rates

A notable shift in market sentiment has come from the Federal Reserve’s decision to cut interest rates by 50 basis points. The Fed’s move boosted builder confidence, as the National Association of Home Builders (NAHB) Builder Confidence Index increased two points to 41. The South and West showed gains, rising to 40 and 42 points, respectively. LBM Journal highlighted that “builders now have a positive view for future new home sales for the first time since May 2024.” However, this optimism comes with a cautionary note. The lower rates may increase competition as more existing homes hit the market due to a weakened mortgage rate lock-in effect.

Affordability Trends: New Construction vs. Existing Homes

In a welcome turn of events, affordability pressures are easing, offering a glimmer of hope for prospective homebuyers. Affordability remains a challenge, but there are signs of relief. Both the median and average prices for new homes have dropped by over 2% year-over-year, while existing home prices have increased by almost 4%. This gives single-family homebuilders a competitive advantage, allowing them to attract more price-sensitive buyers. This price softening, combined with declining mortgage rates (currently at 6.08%, down from 7.12% a year ago), may encourage more first-time buyers and existing homeowners to enter the market. As Ali Wolf at Zonda explained, “the hope is that lower interest rates will help pull more consumers off the sidelines.”

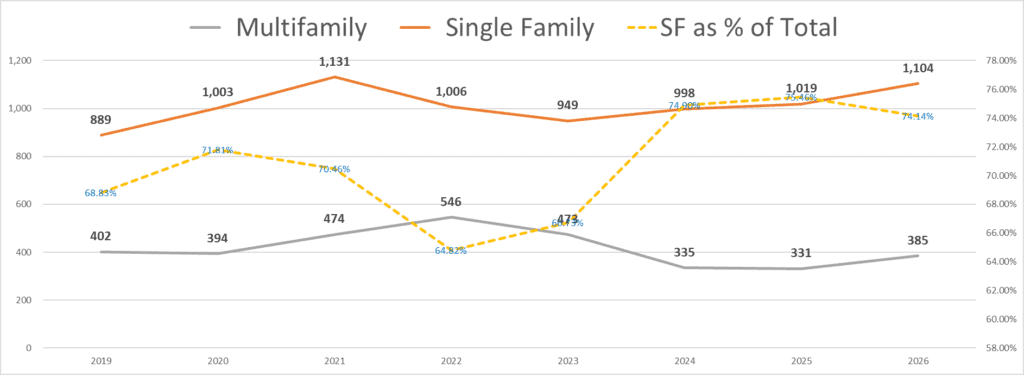

Forecasts for 2024 and Beyond: Modest Growth Expected

The NAHB’s revised Executive Level Forecast for 2024 projects single-family starts at 998,000 units, a slight 0.61% downgrade from previous estimates. However, Q4 is expected to outperform earlier forecasts, which could mean that the worst is behind us. For 2025, the NAHB expects a modest annual growth rate of 3.15%, with 1,019,000 single-family starts forecasted.

This outlook suggests potential for organic growth in 2024 and 2025, but industry participants remain cautious. Todd Tomalak from Zonda warns, “the psychological safety net of predicting a future that feels ‘similar to right now’ is causing a bit of complacency in the industry. Don’t be complacent!”

Key Takeaways for Construction and Lumber Markets

While the US construction market trends show signs of recovery, builders and suppliers should approach the coming months with the apparent theme of 2024; cautious optimism. Here are the critical takeaways:

- Regional Differences Matter: The South is still lagging year-over-year, while the West shows more promising trends. Adjust regional forecasts accordingly.

- Builder Confidence on the Rise: The recent rate cuts have helped boost confidence, but competition from existing homes may pose challenges.

- Affordability Trends Favor New Builds: With new home prices dropping and mortgage rates declining, builders have a slight advantage over the existing home market.

- Stay Agile: While forecasts indicate modest growth, shifts in pricing, labor, and distribution require vigilance and the ability to pivot quickly.

By keeping a close eye on evolving market dynamics and making data-driven decisions, those in the construction and lumber sectors can navigate with success. Understanding the intricacies of these housing market trends and consumer behavior will be important in maximizing opportunities.