Heading into the fourth quarter, Belco leadership has no interest in dressing up difficult market realities with a positive spin or happy-go-lucky rhetoric. We’ve ridden the waves of economic volatility before, and our steadiness comes from a culture rooted in unflinching strategy and the willingness to look at the market we’re currently facing straight in the face. With that said, this month’s unexpected tariff hike on Canadian softwood lumber is definitely urgent news, and it will echo chaotically through the industry. But it’s the quieter work, building and protecting the right partnerships, that secures lasting resilience. Let’s dive in.

Market Update: The Usual Benchmark Data

According to the U.S. Census, single-family starts for August reached 890,000 SAAR, down 7% from July and 11% year-over-year. Moreover, year-to-date starts activity is at 692,600 units, down almost 5% from the same time period in 2024. Permits, a leading indicator for future activity, continue to tell a somber story, coming in at 856,000 in August. This is down 2% from the month prior and approximately 11.5% from August 2024. YTD actual SF permit activity follows the downward trend at 685,200 units, down almost 7% from the same time period last year.

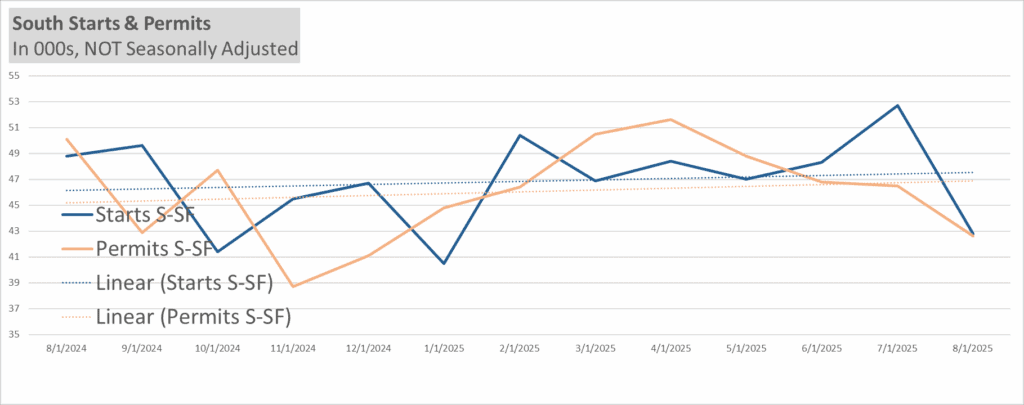

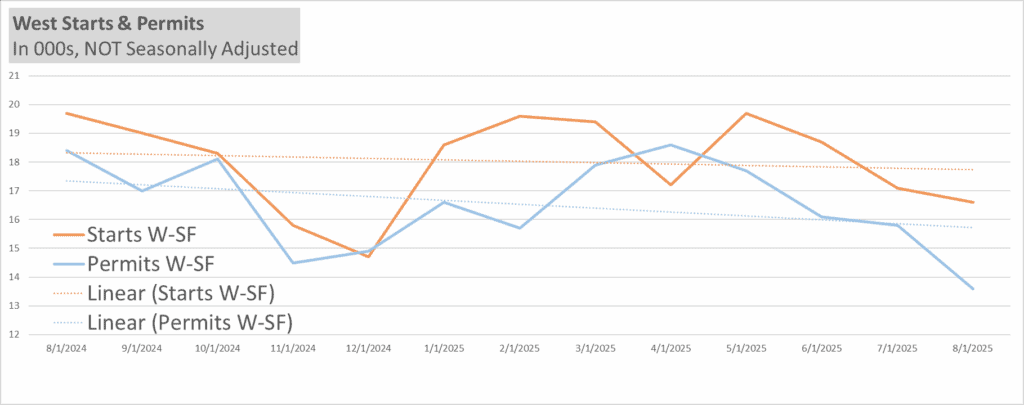

Regional Performance: Split

South: Starts dropped 17% after July’s surge, permits down nearly 11% year-over-year.

West: Starts rose 2% month-over-month, but permits fell 7%, down a staggering 21% compared to 2024.

Affordability and Builder Confidence: Mixed Signals

Chairman of the NAHB, Buddy Hughes, recently shared in HBS Dealer that there may be a glimmer of hope for the future, stating, “Housing affordability is hurting buyer traffic for builders, and as a result, builders have slowed single-family home construction. Nonetheless, our latest survey shows builders reported an increase for future market expectations as mortgage rates have posted a modest decline in recent weeks.”

Reinforcing the small but needed breath of momentum, Zonda reported a 2.1% sales uptick in August, aided by price cuts and incentives. Chief Economist Ali Wolf noted that a shift from 7% to 6.5% mortgage rates opens the door for 2.1 million more households to buy. Also, new homes continue to have the price advantage over existing homes. The July New Home Median price came in at $395,100, almost $37,000 under the existing median home price of $432,000.

However, builder confidence remains muted, with the NAHB Housing Market Index at 32. Sales expectations nudged up slightly (+2 to 45), while traffic slipped to 21.

Looking forward, the NAHB Executive Forecast increased its 2025 starts projection slightly, from 938,000 to 942,000.

Tariff Updates: Short-Term Urgency, Long-Term Impact

The latest tariff news is disruptive, plain and simple. But this is where grit and creativity count, not panicked reaction, but steady problem solving with eyes wide open. Here’s the situation in broad strokes.

Effective October 14, the U.S. has added a 10% tariff on Canadian softwood lumber, which is stacked on top of existing dumping fee duties. HBS Dealer notes the policy now extends to some European imports as well. For builders and dealers, this has certainly demanded urgent attention. Price shifts, allocation questions, and speculation are already rippling through pipeline ranks. But the bigger story lies ahead if Canadian mills shut down and raw material sourcing shifts more heavily toward domestic lumber production. While there are inherent pros and cons and a wide spectrum of opinions on this trajectory, the fact remains that it could cause a supply shock that overshadows the uncertainty of today’s sticker price.

A Word from Jason Staley, Belco Purchasing Manager

Jason has been on the front lines of Belco supply negotiations for decades. His perspective:

“Belco has been strategizing around this potential supply chain trajectory for the better part of a year now. I’ve spoken with Canadian mills almost daily for 25 years, so these are long-time colleagues and friends. The reality is, their mills are facing rising costs, doubled duties, and now a 10% tariff on top of that. At the same time, for stateside builders and dealers, the takeaway is pretty clear: align with partners who have a proven track record of staying engaged and adapting reliably. We’ve invested in strengthening relationships across both Canadian and domestic mills to ensure supply consistency and long-term partnership stability.”

— Jason Staley, Belco Purchasing Manager

Jason’s advice mirrors the heart of this Bulletin: urgent tariff pressures may or may not pass, but the importance of dependable supply relationships is what will fortify resilience.

What’s Important: Partnerships That Protect Supply

Short-sighted reactions often backfire during downturns or unexpected turbulence in business. For example, while some strategic “builder trade-down” is to be expected, switching to cheap materials usually carries hidden costs like callbacks, increased cull, and unreliable deliveries. Each supply chain hiccup tips a domino, and the last one always lands on the red net profit line. In a market like this, it has never been more important to prioritize rock-solid relationships with dependable suppliers who take your timelines seriously.

Final Word

Urgent shifts demand attention. Important priorities require investment.

At Belco, we know the difference. Our commitment is to the relationships, sourcing, and quality that keep projects moving forward with as much efficiency and profit as possible. While tariffs, starts, and confidence will fluctuate, Belco stays clear-eyed and focused on mutual success. Because at the end of the day, we really are in this together.

What, then, is the most IMPORTANT priority at a time like this?

Build relationships with folks who are paying relentless attention, focusing on what matters near AND long term.

Strategic Belco Benefits:

- Tariff resilience: Belco U.S. manufacturing shields partners from added costs.

- Proven reliability: Our On Grade, On Time, Every Time promise has always held, even in volatile markets.

- Exterior trim expertise: Drawing on 50 years in the lumber industry and over two decades of manufacturing innovation, Belco is the only stateside North American manufacturer solely devoted to exterior trim.

Other Big-Picture Takeaways

- Inventory Smart: Plan for flat permits in 2026. Prepare, don’t overreact.

- Partners > Prices: Align with suppliers who will still be standing when demand returns, and avoid the leaky boat of “cheap” stop gaps.

- Loyalty Now: Secure your allocation place before shortages widen.

- Focus Forward: Don’t let urgent pressures distract from long-term partnership strength.