The macroeconomic landscape of the market offers a nuanced narrative for the 2024 residential construction forecast this month. Despite this, Belco marked a record-breaking sales and shipping month, illustrating the importance of informed agility and effective forecasting. Let’s unpack the challenges and indicators:

Macro View: Starts and Permits

Recent census data reveals a slight dip in national single-family starts and permits month-over-month. Although starts saw a modest uptick in the West, both the West and South witnessed declines in permit activity. Yet, on a year-over-year basis, these indicators remain on an upward trajectory, signaling sustained activity, albeit at a slower pace than initially anticipated.

Affordability Challenges: A Barrier for Buyers

For prospective buyers, affordability poses a significant challenge. The Case-Shiller US National Home Price Index saw a marginal increase in February, marking the first uptick since October 2023. Concurrently, the 30-year mortgage rate surged to 7.17% on April 25, 2024, returning to the 7% range for the first time since November 2023. Unfortunately, these factors may prompt some potential buyers to reassess their decisions.

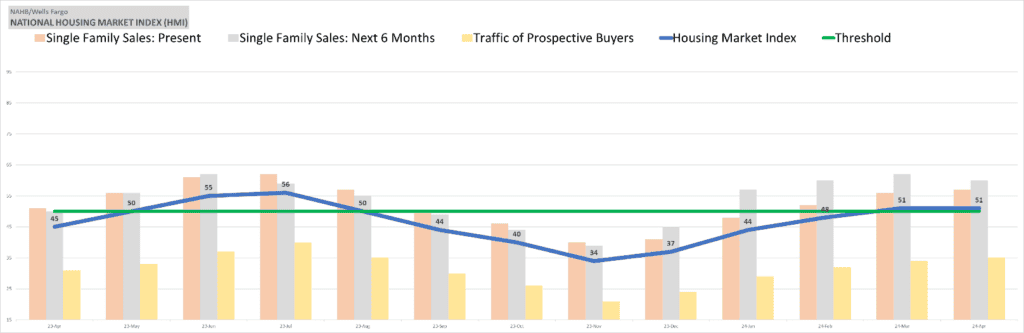

Builder Sentiment: A Mixed Bag

Builder confidence remained flat month-over-month, with the single-family sales forecast for the next six months experiencing a slight decline. This hesitancy among buyers stems from uncertainties surrounding future interest rate movements. According to an article in LBM Journal, “April’s flat reading suggests potential for demand growth is there, but buyers are hesitating until they can better gauge where interest rates are headed.” The journal goes on to say that while markets are adjusting to rates being higher due to inflation, the Federal Reserve is still expected to announce rate cuts later this year. Mortgage rates moderating in the second half of 2024 scaffolds tentative builder sentiment to remain at 51 in April, unchanged from March. The table below sourced from NAHB reflects this “flat” indicator:

Optimism Amidst Challenges: Forecasts and Projections

However, there is room for optimism. The NAHB’s Executive Level forecast still shows single family starts coming in over the 1,000,000 mark for 2024. Zonda suggests a more conservative level at 980,000 starts but both show an increase at a minimum 3% growth over 2023 levels.

Belco’s Sr. Business Analyst, Julie Bradley-Rowan states, “As the Fed sets to hold their current rates longer, the macroeconomic ‘boom’ we were hoping for to kick off in Q2/Q3 could be pushed back until later in 2024.”

Looking Ahead: Staying Agile in a Shifting Landscape

Despite the postponement of the anticipated surge, 2024 still holds promise for the construction industry. NAHB Chief Economist Robert Dietz emphasizes that housing affordability will remain a challenge due to higher-than-expected interest rates and persistently low supply levels. Navigating these challenges requires staying attuned to market dynamics, as different regions face varying obstacles. The real momentum may simply unfold at a later juncture than initially envisaged.

The Belco team works diligently to stay informed and agile, utilizing our superior forecasting model to pivot efficiently and effectively. Stay informed and learn more about our “On Grade On Time Every Time” promise as we navigate these fluctuating market movements.