Winston Churchill once said, “The pessimist sees difficulty in every opportunity. The optimist sees opportunity in every difficulty.” As we look ahead to 2025, the construction and lumber markets continue to face significant obstacles, such as labor shortages, affordability, and most recently a softwood lumber dispute due to new tariffs. However, demanding circumstances often present opportunities for creative ingenuity and unexpected breakthroughs. With a high value for informed awareness and data-driven decision making, Belco remains committed to proactive, thoughtful action within this difficult market landscape. Despite the myriad challenges facing industry players, successful partners understand that optimism is a deliberate, even relentlessly stubborn, commitment to continuous innovation. Stay optimistic with us as we break down the current landscape and explore what’s ahead.

National and Regional Data: A Mixed Bag

Carl Harris, past chairman of the NAHB, highlights the broader issues saying, “As mirrored in our latest builder survey, high construction costs, elevated mortgage rates and challenging housing affordability conditions are causing builders to approach the market with caution. The uncertain policy environment in terms of a better regulatory climate and impending tariffs offers both upside and downside risks in the near-term.” According to Lumber Commentary from RISI, single-family construction is down nearly 2% year-to-date compared to 2024. Cold weather has played a role, but this early dip is concerning and worth monitoring.

As always, awareness of regionally specific market trends is important for accurate inventory projections and strategic project planning. Examining starts and permit data for the South and West highlights notable differences in market dynamics.

South

The South saw a sharp decline in starts, down almost 20% from December and 10% from January 2024. Permits also fell, down 4% from December and 6% from January 2024. With units under construction remaining flat, the hope to build a robust pipeline for future projects looks strained.

West

In contrast, the West is indicating resilience. Starts surged almost 25% from December and 12% from January 2024; a remarkable increase. Additionally, permits while down 5% year-over-year, rose 8% from December. This region’s steady construction pipeline suggests near-term growth potential.

Builder Confidence: Softwood Lumber Dispute, Policy Changes, and Uncertainty

Builder confidence has taken a considerable hit, dropping to a national reading of 42 in the latest NAHB/Wells Fargo Housing Market Index (HMI). This marks the lowest level in five months and reflects growing concerns about the market’s near-term trajectory. Several factors are driving this decline and recent policy developments are impacting the industry. Current sales conditions and traffic of prospective buyers both declined, albeit by single digits. Moreover, sales expectations for the next six months plummeted 13 points to a reading of 46, signaling waning optimism. Builders are grappling with high construction costs, elevated mortgage rates, and persistent affordability challenges. Beyond these familiar hurdles, new Canadian lumber tariffs are adding to the murky market sentiment.

Canadian Lumber Tariffs and Trade: A Significant Shift

The administration’s stance on Canadian lumber tariffs is a significant factor in fluctuating builder sentiment. With 30% of U.S. softwood lumber imports coming from Canada, escalation in tariffs could further inflate material costs. The NAHB has long argued that these tariffs act as a tax on American homebuyers, exacerbating affordability issues.

Carl Harris, NAHB chairman, recently stated, “The uncertain policy environment, particularly around tariffs, offers both upside and downside risks in the near term.” Consequently, many builders are concerned about the potential for increased costs and supply chain disruptions. The unstable nature of negotiations between our two countries has seemingly left both U.S. manufacturers, dealers, and builders as well as Canadian mills in limbo. Many producers are hesitant to ramp up production or make significant investments, fearing abrupt policy reversals. This stop-and-start dynamic has contributed to a broader sense of market paralysis centered around the softwood lumber dispute.

Executive Order: Impact of Domestic Timber Production

In a controversial move that may or may not provide some relief, President Trump issued an executive order aimed at expanding logging in the U.S. National Forests. The order seeks to streamline regulations and increase domestic timber production, which is intended to help alleviate some of the pressure on lumber supply and costs.

For builders, this could be a double-edged sword. While some argue that increased domestic production could help stabilize prices, the environmental and regulatory pushback might also create delays and further uncertainty. Even if the order leads to expanded logging efforts, industry experts warn that the necessary infrastructure, such as milling capacity, logging equipment, and skilled labor, may not be readily available. The logging sector has struggled with labor shortages for years, and acquiring the heavy machinery needed for large-scale production increases won’t happen overnight. If supply chains can’t scale up quickly enough, builders may still face potential lumber shortages despite the policy shift. Consequently, the interplay between increased domestic production and potential tariff impacts will be critical to watch.

Affordability and Incentives: A Shifting Strategy

Builders have increasingly relied on incentives to attract buyers, but even this strategy is losing steam. The February HMI survey showed that 26% of builders reduced prices to boost sales, down 4% from January, while 59% offered sales incentives, down 2% from January.

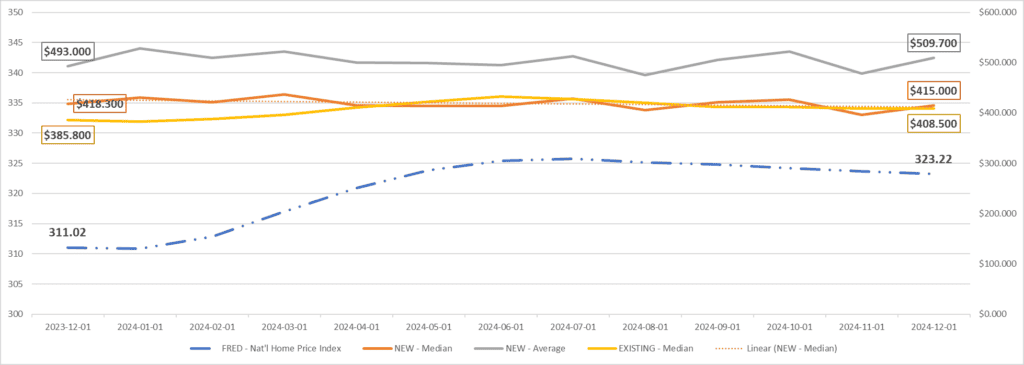

As interest rates remain elevated, the pool of eligible buyers continues to shrink. While slightly lower at 6.76% as of 2/27, rates are still high. The Case-Shiller US National Home Price Index continues its downward trend, but prices are still 5.5% higher than a year ago.

Builders must now balance the use of incentives with the need to maintain profitability, a tricky equation in today’s market. The NAHB’s Q4 Cost of Housing Index (CHI) reveals a median-income family needs 38% of its income to afford a median-priced new home while low-income families would need to spend 76% of their earnings. Additionally, the NAHB Executive Level Forecast published 1,010,000 single-family starts in 2024, a 6.48% increase over 2023. For 2025, the forecast calls for 1,012,000 single-family starts, a modest 0.20% growth. While single-family homes will account for over 76% of starts, the market still faces the headwinds from tariffs, affordability concerns, and regulatory uncertainty.

Final Thoughts: Embracing Challenges

As we look ahead to 2025, the construction and lumber markets will undoubtedly face complex intersections of several nuanced barriers. Yet, within these challenges lie opportunities for those willing to adapt. At Belco, we recognize that seeking market certainty amid so many variables is futile. Instead, the true constants in uncertain times are strong supplier relationships, innovative strategies, and agile responsiveness.

Jason Staley, Belco’s Purchasing Manager says, “I believe that it has been Belco’s holistic approach to the lumber industry that will sustain us for many years. Understanding our suppliers’ business and developing a win/win strategy is the key to making sure our customers will always be taken care of.”

Builder Strategies to Consider

By continuing to focus on affordability and innovation, builders can position themselves to succeed even in a constrained environment. Some things to consider:

- Continue to offer targeted incentives to attract buyers

- Consider adjusting plans to meet consumer price points

- Stay informed in the face of policy and market shifts

- Network with trustworthy trade partners for collaborative problem solving

The 2025 market may not provide the momentum we hoped for, but it does offer a chance to rethink strategies and embrace creativity. As Churchill reminds us, optimism isn’t about ignoring difficulties, it’s about courageously finding a path forward despite them.