Regional Analysis

Southern Region: Three Consecutive Months of Declines

In the South, housing starts have declined for three consecutive months. This region saw another dip in permits after a promising uptick last month. Although starts are down year-over-year, permit activity remains strong. According to the NAHB’s semi-annual forecast, Florida and Texas are leading with single-digit declines in single-family starts for 2024 over 2023. When including multifamily units, these states face double-digit declines.

Western Region: A Mixed Bag of Indicators

The West experienced its first increase in starts since December, however permits declined for the fourth month in a row. Year-over-year, both starts and permits are up, suggesting better performance than initially expected for 2024. While single-family growth is anticipated across all Western regions, only Colorado and Washington are expected to show total growth, including multifamily units.

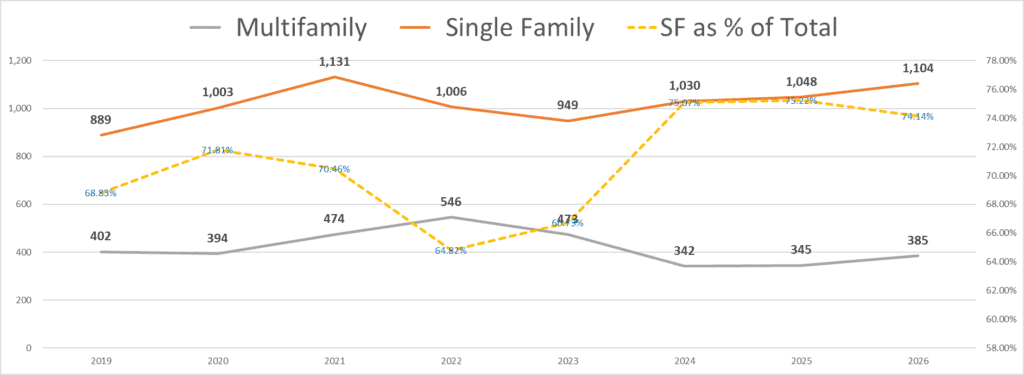

National Outlook and Forecast Adjustments

The NAHB’s Executive Level forecast remains optimistic for the long term, yet they have revised their Q1 numbers down by about 1%. The annual single-family starts count was adjusted to 1,030,000 units, marking a slight decrease of 0.22% from last month’s forecast. This revision, though minor, suggests a cautious approach moving forward. The graph below released by NAHB includes both historical housing market data to date, as well as projections into 2026 on multifamily and single family performance:

Affordability Challenges and Market Dynamics

Affordability concerns continue to challenge the industry. The Case-Shiller US National Home Price Index reached 320.419 in April, marking increases of 1.17% from March, 3.14% since the start of the year, and 6.29% from a year ago. Mortgage rates are stabilizing but remain near 7%, impacting buyer affordability.

According to a recent LBM Journal article, existing home sales fell for the third straight month in May due to high mortgage rates and record-high prices. It goes on to state that, “Homeowners with lower mortgage rates have opted to stay put. This trend is driving home prices higher and resale inventory lower. Eventually mortgage rates are expected to decrease gradually. However, that decline is dependent on future inflation reports.”

Builder Confidence Index Trends

The national builder confidence index dropped yet again, from 45 to 43. The South experienced a similar two-point drop, while the West saw a slight increase from 37 to 38. The June survey revealed that 29% of builders reduced prices to boost sales, with sales incentives rising to 61%. While building more new homes is critical to lifting the market out of its slump, these conditions for builders are challenging.

Construction Industry Statistics: Regional Implications

Zonda has repeatedly emphasized this, and the housing market data confirms it; the state of the industry varies by location. Last month, the South seemed poised for growth, but recent data shows a cooling trend. The West appears favorable for growth through the end of the year but faces its own challenges. Staying attuned to both market-wide trends and local builder reactions is imperative. Furthermore, for manufacturers, home builders, and dealers, understanding these regional trends and adjusting strategies accordingly will be essential. Keep an eye on economic indicators, builder confidence, and market dynamics with Belco to stay ahead in this evolving landscape.