Have you ever listened to an old vinyl record played at the wrong speed? There’s something distinctly uncomfortable about hearing a song you know and love, suddenly distorted and dragged slowly off kilter. Add a scratch that causes the needle to jump, repeating the same broken phrase, and you’ve truly entered a grating kind of sonic madness.

Recent construction market reports might feel similarly distorted and repetitive, especially when compared to the hopeful forecasts we heard late last year. Yet, as industry play-makers, we know that successfully navigating a disheveled and uncertain market isn’t just a challenge, it’s a part of the craft. In these prolonged periods of increased difficulty, dexterity and resilience is not optional. It’s required.

The Honest Ongoing Downshift

June’s housing data offers sobering clarity: nationally, single-family housing starts linger at nearly flat levels – 924,000 units – and permits declined another 3%, down 6% year over year, according to the U.S. Census Bureau.

NAHB Chief Economist Robert Dietz echoed this shift, emphasizing that the previously “optimistically flat” outlook is now tilting downward. Persistent macroeconomic pressures ranging from higher mortgage rates to rising construction costs and broad economic unpredictability are playing a significant role. Unfortunately, the NAHB continues to forecast that 2025 will ultimately register a decline in single-family housing starts.

Regional Contrasts: The Brass Tacks

- South: Starts are down almost 11% YTD compared to 2024. Permits peaked in April and declined 7.31% year-over-year.

- West: Starts rose over 10% month-over-month but remained down 17% from last year, with permits dropping sharply—10% lower than 2024.

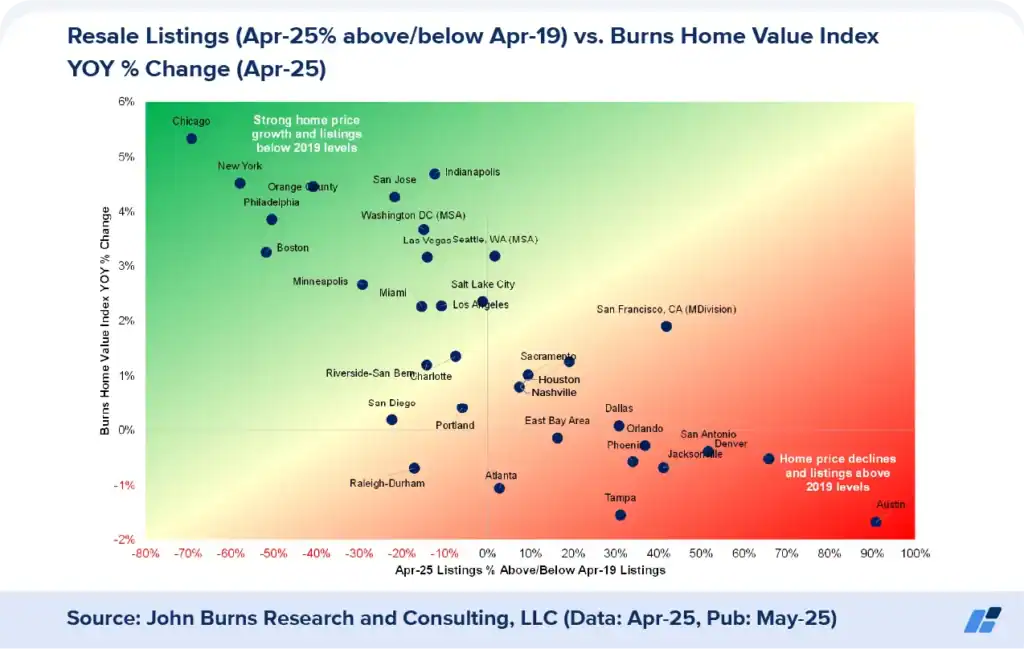

According to John Burns Research & Consulting, oversupply issues in key regions like Texas and Florida are forcing builders to pivot, aligning construction activity with current regional market realities. While frustrating at best, this is a prime example of the strategic agility that informed builders learn to lean into during market downturns.

Builder Confidence at Historic Lows

Builder confidence hit its lowest point since November 2023, with the June Housing Market Index reading at 32. This downturn reflects reduced traffic from potential buyers and declining sales expectations. Moreover, a staggering 37% of builders have cut prices to stimulate sales, marking the highest level since NAHB began tracking this metric.

Affordability Challenges Persist

Affordability pressures continue, with mortgage rates still hovering around 6.77%. Both existing and new home markets reached 12-month highs in supply, potentially intensifying competition among builders. The Harvard Joint Center for Housing Studies‘ “State of the Nation’s Housing” highlights the severity of the nation’s housing predicament:

- Half of all renters now spend over 30% of their income on housing.

- Rising insurance and property taxes contribute to declining homeownership rates.

- Existing home sales hit a 30-year low, prompting builders to reduce home sizes and increase buyer incentives.

Chris Herbert of the Harvard Joint Center stresses, “There must be a concerted effort to do more to address affordability and supply crises. The consequences of inaction are simply too harmful.”

Staying Strategic with Belco

In times like these, builders and dealers need more than reliable materials. They need genuine, no-nonsense partnership, innovation, and strategic solutions. Belco has always been and will remain committed to supporting customers with products designed to streamline installation, reduce waste, increase net profit, and ensure long term quality for homeowners. Our XT line of preservative-treated products exemplifies this commitment.

Each market cycle brings an opportunity to refine, adapt, and strengthen. Belco is here to support you every step of the way.